Choosing where you bank is more than just a financial decision—it’s a personal one. At Marshfield Medical Center Credit Union, we pride ourselves on being more than a financial institution. We’re a trusted partner in your financial journey, committed to helping our members thrive.

Unlike traditional banks, credit unions operate with one mission in mind: serving their members. MMCCU is no exception. We return value directly to our members through lower loan rates, higher savings rates, and fewer fees—benefits that can make a significant difference in your financial wellbeing.

Real Value You Can See

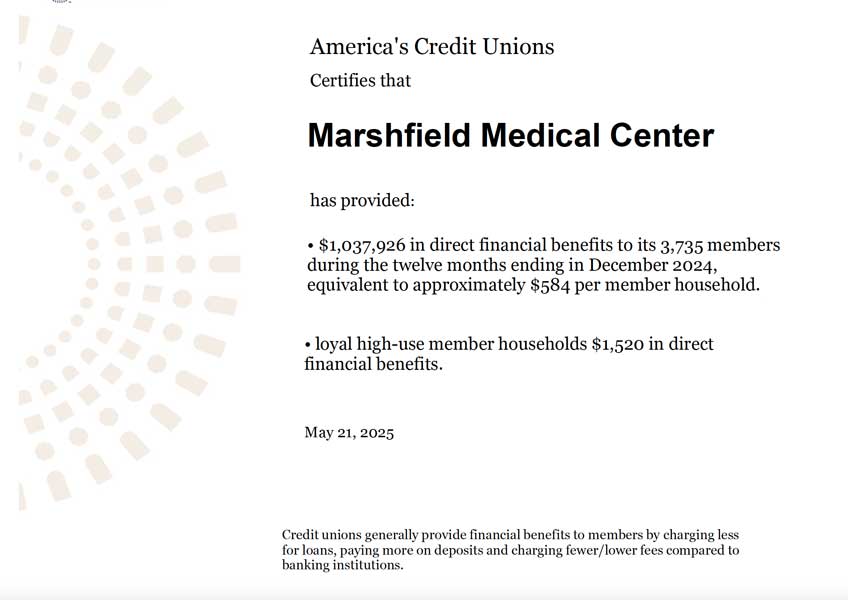

According to recent data from America’s Credit Unions, MMCCU delivered $1,037,926 in direct financial benefits to its 3,735 members during the twelve-month period ending December 2024. That’s an average of:

- $278 per individual member

- $584 per member household

These aren’t just numbers—they represent meaningful savings that help our members meet their financial goals, from buying a car to saving for retirement.

Everyday Savings That Add Up

Let’s look at a real-world example. Financing a $30,000 new vehicle for 60 months through MMCCU can save a member approximately $168 per year in interest compared to financing through a typical banking institution. Over the life of the loan, that adds up to $840 in savings—money that stays in your pocket.

And the more you use your membership, the greater the benefits. For households that actively use MMCCU for multiple financial needs—what we call loyal high-use households—the average annual benefit is even more impressive: $1,520 in direct financial value.

Competitive Products. Exceptional Value.

MMCCU excels in offering competitive loan and savings products designed to benefit our members, including:

Lower Loan Rates On:

- New car loans

- Used car loans

- Personal unsecured loans

- First mortgage – fixed and adjustable rate

- Home equity loans

Higher Dividends Paid On:

- Share draft checking accounts

- Money market accounts

- Individual Retirement Accounts (IRAs)

By focusing on member needs rather than shareholder profits, MMCCU ensures that more of your money works for you. Our goal is simple: to provide smart financial solutions that support our members at every stage of life.

Why Choose MMCCU?

When you become a member of MMCCU, you’re not just opening an account—you’re joining a community. A cooperative. A place where your financial wellness is our top priority.

Experience the MMCCU difference today and discover what membership truly means.