Preparing to buy your first home is an important and often complex process. MMCCU also offers a specific First Time Homebuyer Loan that can help.

Here are some steps you can take, and ways in which a credit union like Marshfield Medical Center Credit Union can assist you:

- Assess Your Financial Situation:

- Review your current financial situation, including your income, expenses, and debts. Understand how much you can comfortably afford to spend on a home.

- Create a Budget:

- Create a budget that takes into account not only the mortgage payment but also property taxes, insurance, and maintenance costs.

- Check Your Credit Score:

- A good credit score is essential to qualify for favorable mortgage rates. Check your credit report and address any errors or outstanding debts. Credit unions often provide services to help you improve your credit score.

- Save for a Down Payment:

- Start saving for a down payment. You can get into a home with as little as 5% down of the home’s purchase price, however a 20% down payment will save you more and open up addition payment options. . Credit unions may offer savings accounts and financial planning services to help you reach your down payment goal.

- Pre-Approval for a Mortgage:

- Contact MMCCU for mortgage pre-approval. We can help you understand your borrowing capacity and provide you with a pre-approval letter, which can make your offers more attractive to sellers.

- Research and Choose a Real Estate Agent:

- A knowledgeable real estate agent can help you find the right home and navigate the buying process. They may also have insights into the local real estate market.

- Home Search:

- Start searching for homes within your budget, considering factors like location, size, and amenities.

- Make an Offer and Negotiate:

- Work with your real estate agent to make an offer on the home. Negotiate the terms and price with the seller.

- Home Inspection:

- After finding a potential home, hire a professional home inspector to assess the property’s condition and identify any potential issues.

- Secure Financing:

- Finalize your mortgage application with the credit union. They can guide you through the mortgage approval process, offer competitive rates, and provide options for different types of mortgages.

- Close the Deal:

- Once your offer is accepted, you’ll go through the closing process, where you sign the necessary paperwork, transfer funds, and officially become the owner of the property.

How MMCCU can help:

- Mortgage Services: Marshfield Medical Center Credit Union offers a range of mortgage products with competitive rates and terms. We can help you find a mortgage that suits your financial situation.

- Financial Counseling: We provide financial counseling services to help you manage your finances and improve your credit score if needed.

- Savings Accounts: We offer savings accounts and investment options to help you save for a down payment and cover other homeownership costs. MMCCU also offers a specific First Time Homebuyer Loan that can help.

- Pre-Approval: We can provide pre-approval for a mortgage, giving you a clear picture of your budget and making you a more competitive buyer.

- Personalized Assistance: We provide personalized service and are community-oriented, which is beneficial for first-time homebuyers.

We’re here to help! Are you ready to take the exciting leap into homeownership? MMCCU is excited to offer a First-Time Homebuyer Loan, designed to make your home-buying journey smoother and more affordable.

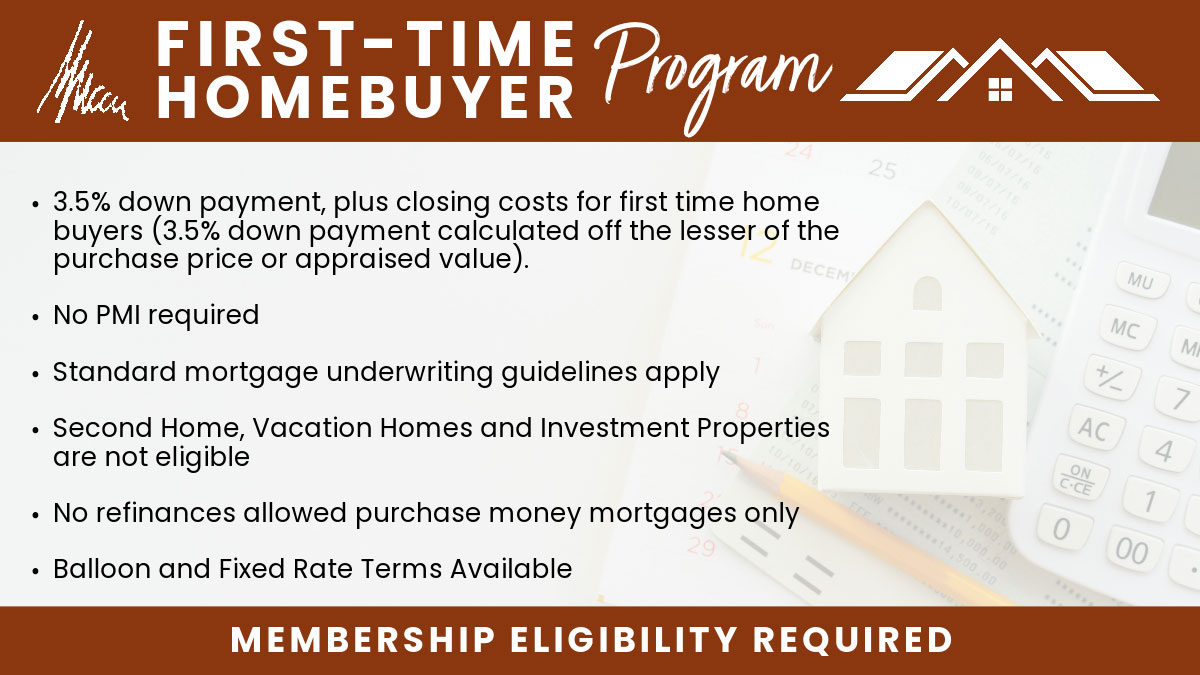

Low Down Payment: With our First-Time Homebuyer Loan, you’ll only need a 3.5% down payment based on the lesser of the purchase price or appraised value. This means you can get closer to owning your dream home with a minimal upfront cost.

No PMI Required: Say goodbye to Private Mortgage Insurance (PMI). MMCCU’s First-Time Homebuyer Loan eliminates the need for PMI, saving you money and making homeownership even more accessible.

Flexible Mortgage Options: Whether you prefer a balloon payment or a fixed-rate mortgage, we’ve got you covered. Choose the option that suits your financial goals and lifestyle.

Membership Eligibility: To take advantage of this fantastic opportunity, you’ll need to become an MMCCU member. Our membership is open to those who meet our eligibility criteria, ensuring that our First-Time Homebuyer Loan is available to those who need it most.

Not for Refinancing: Please note that this loan is exclusively for purchasing your first home. Refinancing, second homes, vacation homes, and investment properties are not eligible.

Standard Underwriting Guidelines: Rest assured that our loan follows standard mortgage underwriting guidelines, providing you with a transparent and straightforward application process.

Are you ready to make homeownership a reality? Contact us today to learn more about MMCCU’s First-Time Homebuyer Loan and take the first step toward securing your dream home. Your journey to homeownership starts here!

Disclaimer: Terms and conditions may apply. Membership eligibility required.